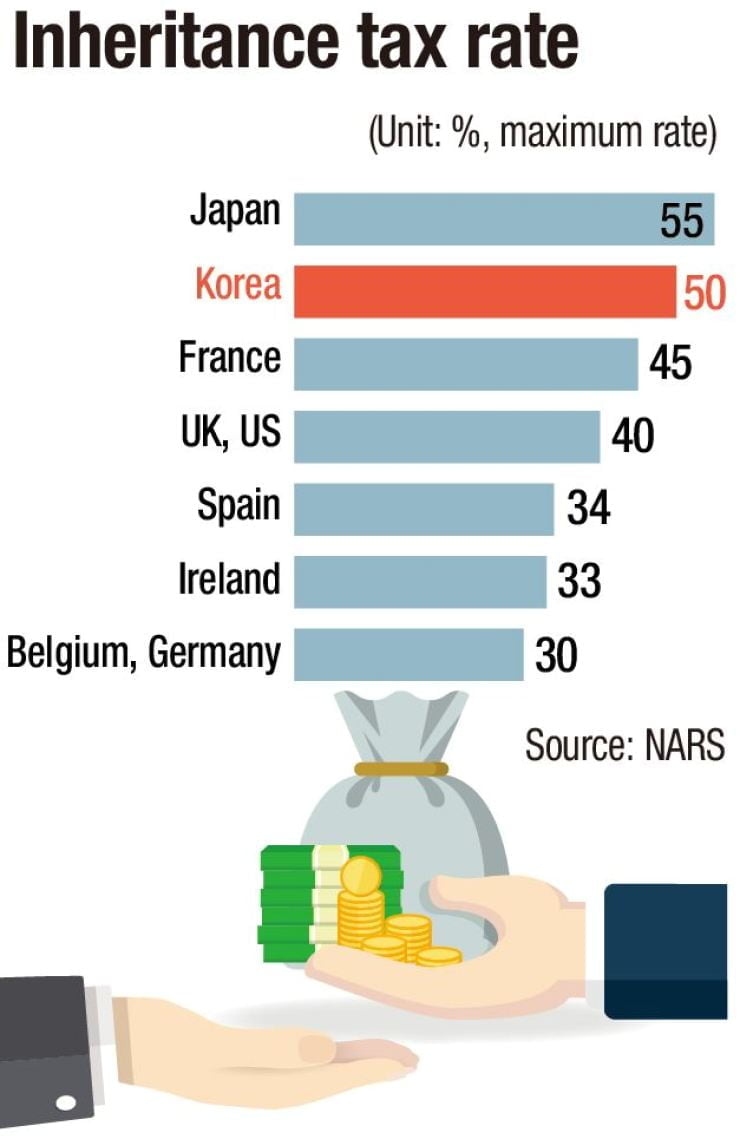

Is the owner who paid the real estate inheritance tax?The inheritance tax is largely “inheritance registration” and “inheritance tax.”There are about six taxes in the registration of inheritance, including acquisition tax, which is handled by a judicial scrivener, and the inheritance tax is handled by a tax accountant.All inheritance-related taxes are jointly and severally obligated to be paid by all heirs, and just because heiress A pays all the real estate inheritance taxes does not mean that heiress A has all the authority to own property.

The decision was made after looking at the tax estimate of the real estate inheritance judicial scrivener. Please check the picture of the cost estimate below the sentence you are looking at now and apply for consultation. Instead, you can apply for text messages, messages, and e-mail consultations.

Statutory method of inheritance can be processed without meeting.If a decedent dies, the heir has a legal right to his/her own share.When inheritance is processed as it is, this is called legal inheritance. In this case, you can send only the necessary documents related to inheritance to the judicial scrivener without face-to-face contact.The necessary documents are different from the negotiated inheritance, so please send the necessary documents by post office registration.Even if we proceed with the inheritance of real estate in Wolgye-dong, Gwangju, we can handle it without coming to Gwangju.

If you have to proceed with the inheritance of real estate in Wolgye-dong, Gwangsan-gu, Gwangju, which city judicial scrivener you need to use, Gwangju attorney is not the only one who needs to use it.You can use Jeolla-do city lawyers, including Gwangju Lawyers, Naju Lawyers, Jangseong-gun Lawyers, Damyang-gun Lawyers, and Hwaseun-gun Lawyers, and if your heir lives in another area, you can use the district’s lawyers.The advantages and disadvantages are different, so please compare them carefully and decide according to the situation.

In the cost estimate, we will send you an estimate for tax + handling fee when we apply for tax inquiry for real estate inheritance judicial scrivener.If you get a cost estimate, the total cost will be several to tens of millions of won, but most of them are taxes and the judicial scrivener fee is not high.It is less than 50% compared to other real estate-related industries such as certified brokers and tax accountants.

Isn’t acquisition tax a tax paid when buying and selling?The acquisition tax is paid at the time of purchase and sale, but the registration fee is always paid at the time of acquisition and registration whenever other property transfer registration, such as inheritance, gift, and exchange, is paid.Inheritance is also the acquisition of a new estate owned by a decedent.Isn’t acquisition tax a tax paid when buying and selling?The acquisition tax is paid at the time of purchase and sale, but the registration fee is always paid at the time of acquisition and registration whenever other property transfer registration, such as inheritance, gift, and exchange, is paid.Inheritance is also the acquisition of a new estate owned by a decedent.Previous Image Next ImagePrevious Image Next ImagePrevious Image Next Image